Homeownership guideManaging a mortgageRefinancing and equityHome improvementHome valueHome coverage

Options require threat and therefore are not well suited for all traders. Evaluate the Attributes and Pitfalls of Standardized Alternatives brochure prior to deciding to commence investing alternatives. Solutions traders may perhaps drop the entire number of their investment decision or maybe more in a relatively short time frame.

Standard financial loans are backed by non-public lenders, similar to a bank, rather than the federal government and infrequently have demanding specifications close to credit score and credit card debt-to-revenue ratios. Should you have great credit by using a 20% down payment, a standard personal loan could be a excellent choice, as it usually provides lower fascination charges devoid of personal mortgage insurance policies (PMI).

Greg McBride is often a CFA charterholder with in excess of 1 / 4-century of expertise in own finance, including purchaser lending just before coming to Bankrate. By Bankrate.com's Money Makeover series, he aided individuals program for retirement, handle credit card debt and produce proper expenditure allocations.

While in the reverse mortgage loan, it is often secured for just a residence that allows the borrower to accessibility the unmortgaged price of the house in dilemma. Reverse mortgages permit homeowners to transform their property’s equity into authorized tender profits, without any month to month mortgage payments.

d(1) : an entry on the correct-hand facet of the account constituting an addition to the earnings, Web really worth, or legal responsibility account (2) : a deduction from an cost or asset account e : any one of or maybe the sum in the merchandise entered on the proper-hand facet of the account f : a deduction from an amount of money check here normally because of

With that in mind, we've investigated the top mortgage organizations to provide you our picks for the best online mortgage lenders. Consider our shortlist below in addition to a rundown of many of A very powerful points to find out about the online mortgage market.

Q9. What is a household mortgage, do I would like it? Ans. A residential mortgage is a mortgage for a house you are intending to are in.

These examples are programmatically compiled from a variety of online resources to illustrate latest usage on the word 'credit.' Any views expressed in the examples never represent All those of Merriam-Webster or its editors. Deliver us suggestions about these examples.

Plenty of people who invest in a house, get it done that has a mortgage. It can be of terrific use If you're able to’t pay back the complete volume by by yourself

There are several significant advantages to getting a mortgage preapproval. A single, it displays sellers that you could produce a stable offer as much as a particular price tag. Two, it can help you determine what your mortgage will definitely Value, due to the fact you will get facts on the speed, APR, expenses and various closing prices.

Overview your current mortgage estimate and shutting disclosure. You will get this three days ahead of the scheduled closing date. Examine these new paperwork to what you acquired after you had been originally authorised, so that you can find out if And the way any prices have modified unexpectedly.

Bankrate has reviewed and associates with these lenders, and the two lenders revealed very first have the best combined Bankrate Score and shopper ratings. You should utilize the fall downs to check out further than these lenders and locate the most suitable choice for you.

Exactly how much is your deposit? Simply how much is your deposit? Just an estimate is okay. You are able to update the quantity later in the procedure. Following

Devin Ratray Then & Now!

Devin Ratray Then & Now! Yasmine Bleeth Then & Now!

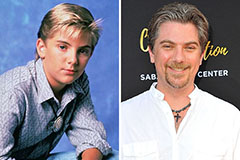

Yasmine Bleeth Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Burke Ramsey Then & Now!

Burke Ramsey Then & Now! Batista Then & Now!

Batista Then & Now!